CoinUp has risen above many cryptocurrency exchanges to become one of the best trading platforms within the blockchain-based economy.

Due to the boom in crypto over the past year, many exchanges have battled for dominance, but few have survived.

Recently, CoinUp has become a surprise contender to Binance’s status as the biggest crypto exchange by volume.

On November 27, 2025, CoinUp saw about $22 billion in the day’s trading volume.

This eclipsed Binance by $5 billion after the exchange raked in about $17 billion, data from Statista showed.

This metric has led to several questions among crypto analysts. While some believe CoinUp has the tools to dethrone Binance, others remain sceptical.

This is because XXKK and SuperEx tested Binance’s dominance during the early months of 2025. Periodical reports by mainstream organisations fail to mention any of their milestones.

Let’s dive deep into CoinUp by analysing its rise, data, and potential implications for the exchange market.

What Is CoinUp and How Did It Rise So Quickly?

CoinUp was founded in 2021 as a centralised cryptocurrency exchange. Like many CEXs, derivatives and spot trading are among its offerings.

Registered as a virtual asset service provider (VASP), CoinUp supports the trading of several cryptocurrencies, which includes Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

To gain the support of many traders, CoinUp has integrated advanced features into its system. Copy trading, which allows novice traders to follow the trading patterns of experts, has been embedded.

What’s more, futures contracts and perpetual contracts for stock have also been integrated into the CoinUp system.

As a result, traders and investors can find stocks like Apple (AAPL) and Tesla (TSLA) on the centralised exchange.

Like many projects operating under the confines of the crypto economy, CoinUp also has a token. CP is the novel token that oversees transactions on the CP Chain.

This is a layer one blockchain that is compatible with Vitalik Buterin’s Ethereum Virtual Machine (EVM).

Focusing on the advantages, this exchange attracts millions of users because of its low fees. As a trader, one of the primary metrics you cannot take your eyes away from is trading volume.

Trading volume signals liquidity, and CoinUp has demonstrated consistency in generating more than $1 billion in daily trading volume. You can’t deny their innovative tools that meet users’ needs.

Regarding accessibility, you can find mobile applications on the App Store for smart devices powered by iOS. Smart device users whose phones, pads, and tablets are powered by Android can also find the CoinUp mobile application on the Google Play Store.

To keep millions glued to the platform, it runs frequent promotions and giveaways in the form of airdrops. Studies have demonstrated that these initiatives enhance community engagement.

Breaking Down the Trading Volumes on November 27, 2025

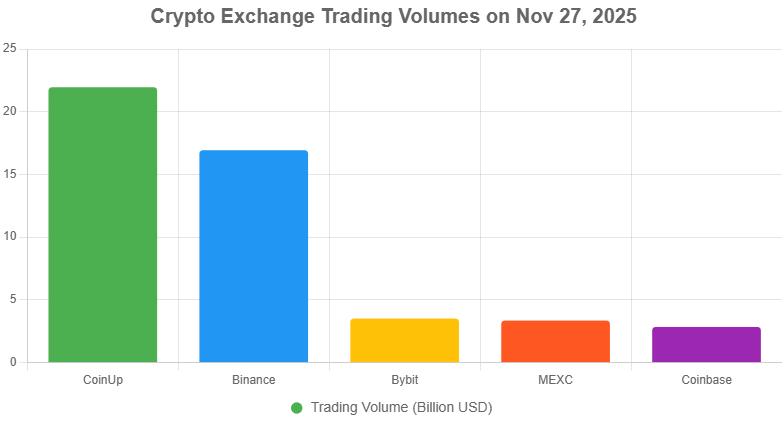

Statista data, which is among the reliable sources in the financial economy, painted a clear picture of what unfolded that day.

CoinUp led the market with $21.95 billion in a 24-hour trading volume.

In second place was Chanpeng Zhao’s Binance, which trailed CoinUp at $16.93 billion. Bybit followed in a distant third with $3.51 billion, while MEXC closed the day with $3.35 billion in volume.

Coinbase, the largest crypto exchange by trading volume in the United States, came fifth with $2.84 billion.

This surge disclosed a major shift in daily trading volume within the volatile crypto market. Statistically, CoinUp had more than 30% more in volume than Binance. This spike showed its growing appeal within the digital assets market.

Key Factors Fuelling CoinUp’s Surge Past Binance

Several factors in trading have propelled the exchange to its current metrics. The most significant factor is CoinUp’s competitive leverage options. You can get up to 125 times in futures trading. High-risk traders have identified this feature as a key attraction.

In contrast to Binance, which has held the title of the biggest crypto exchange by trading volume for a long time, Chanpeng Zhao continues to face regulatory pressures.

The regulatory environment has undoubtedly made it difficult to include some of these in certain regions where traders have huge sums of money to risk.

Operating from Singapore, which has been a friendly place for crypto for a long time, has given CoinUp leverage over Binance.

Additionally, integrating Web3 elements, such as the CP Chain, has made it possible for DeFi stakeholders to seek a linkage between centralised finance (CeFi) and DeFi.

Aside from these, marketing has played an integral role in the fortunes of this trading platform. Aggressive promotion has been carried out on social media as well as partnerships.

Such activity has contributed immensely to the addition of new users to the platform.

Many reports show that meme coin hype coupled with alternate coin (altcoin) rallies has played an invaluable role in seeing the exchange reach such heights in the fall of 2025.

One thing that has made CoinUp stand out is that traders have become accustomed to exchanges that list trending tokens.

Since most trending tokens are normally obtained via decentralised exchanges and wallets, having CoinUp, a centralised exchange, provide this resource has seen it excel in ways where other CEXs failed.

Does This Make CoinUp a Real Threat to Binance?

Yes, CoinUp is a threat to Binance despite the latter’s dominance within the industry. That said, Chanpeng Zhao’s innovation still holds the edge in the decentralised trading world.

Binance is the leader when it comes to massive liquidity within the trading of major crypto pairs such as BTC/USD, ETH/USD, SOL/USD, and others.

Aside from that, Binance benefits from its staking services, where it provides stakers with above-average percentage yields (APYs).

Moreover, Binance is a major player within the non-fungible token (NFT) ecosystem. Binance Smart Chain is the eighth largest NFT blockchain in terms of sales volume.

BNB Chain had total NFT sales of $808 million as of this writing. It trails Immutable, Flow, Polygon, Ronin, Bitcoin, Solana, and Ethereum.

Despite Binance’s positives, it has faced setbacks and regulatory fines, which have destroyed its reputation in the eyes of many traders. Frequently, people mention or list Binance as one of the cryptocurrency platforms that facilitate money laundering. CoinUp has so far steered clear of such mentions, listings, and regulatory problems.

While CoinUp has faced criticism for withdrawal problems, it still offers innovative features that can see it challenge Binance’s status as the go-to trading platform.

Can CoinUp Sustain Its Lead?

2026 is a great year for the cryptocurrency industry due to the boom in artificial intelligence (AI), the metaverse, and big data.

CoinUp is eager to expand its reach and penetrate new markets. This could potentially lead to new listings due to the launch of new projects within the crypto economy.

That said, many developers still see Binance as the prime exchange to list their digital currencies.

Crypto analysts believe digital asset volume will rise in 2026. Therefore, if CoinUp resolves its transparency and withdrawal problems, it can become a mainstay within the exchange economy.

If the development team behind the exchange does not evolve and stay relevant with new innovations, surpassing Binance might prove temporary.

CoinUp’s $5 billion leap over Binance on that fateful day shows a potential shift in the CEX market. This helps traders find a myriad of exchanges where they can trade and invest their hard-earned money.

As the crypto economy evolves in 2026, this trajectory will reveal if CoinUp will be a fleeting challenger like XXKK and SuperEx or a lasting rival like Coinbase, Kraken, Bybit, and others.