Bitcoin continues to transform as institutional investors pour in billions, reshaping its role from a niche digital asset to a mainstream financial staple.

Recent data reveals that institutions now control nearly 30% of Bitcoin’s supply, amounting to about 5.94 million BTC.

Moreover, corporate holdings have skyrocketed from 197,000 BTC in January 2023 to 1.08 million BTC today—a staggering 448% increase.

This surge prompts a critical question: Does this institutional embrace signal positive momentum for Bitcoin in 2026 and beyond?

Experts argue yes, citing enhanced stability, liquidity, and adoption. However, challenges like volatility persist.

This review explores the trends, drivers, implications, and future outlook to provide a comprehensive guide for investors.

Decoding the Recent Institutional Surge

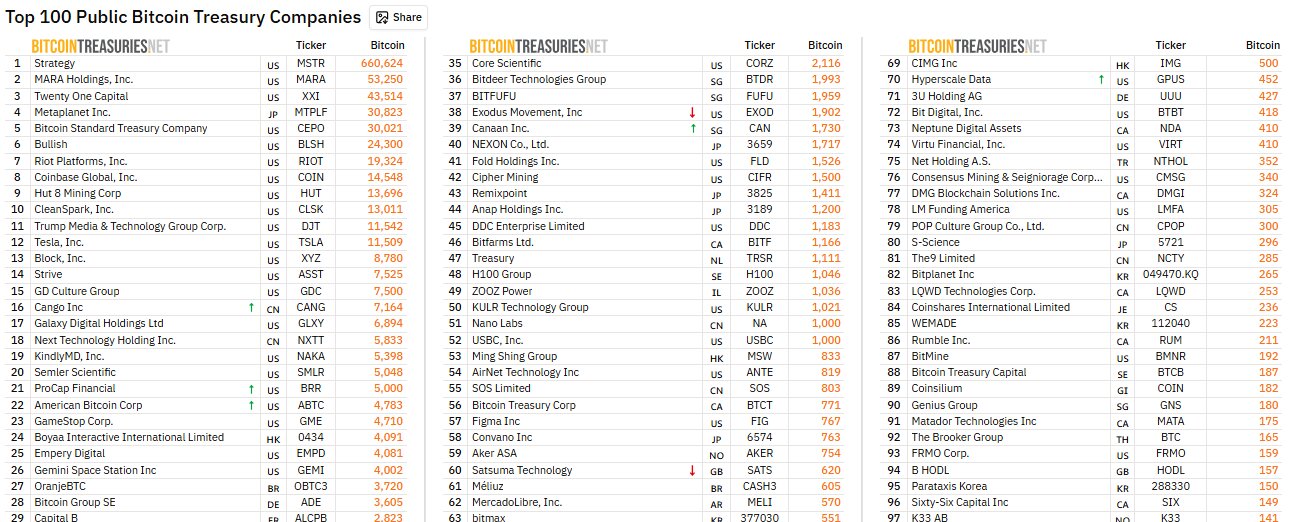

Institutions actively accumulate Bitcoin at unprecedented rates. For instance, public and private companies have aggressively built their treasuries, with MicroStrategy leading the charge by holding over 660,624 BTC at the time of this publication.

Additionally, entities like Harvard University boosted their BlackRock Bitcoin ETF holdings by 257% in Q3 2025, reaching $442.8 million.

Meanwhile, sovereign funds, such as Abu Dhabi’s Investment Authority, tripled their exposure to BlackRock’s IBIT ETF, signalling global confidence.

Furthermore, ETF inflows tell a compelling story. Spot Bitcoin ETFs will absorb billions of dollars in 2025, countering long-term holder sales and stabilising supply.

Giants like Vanguard, Bank of America, and Charles Schwab plan Bitcoin trading expansions in 2026, potentially unlocking trillions in client assets.

This shift shows how institutions view Bitcoin not as speculation but as a strategic hedge.

Key Drivers Fuelling Bitcoin Institutional Adoption

Several factors propel this trend. First and foremost, regulatory clarity accelerates entry.

The U.S. CLARITY Act, with 80% odds of passage by early 2026, classifies Bitcoin as a commodity, reducing Security and Exchange Commission (SEC) hurdles.

In Europe, the Markets-In Crypto Assets (MiCA)’s enforcement bolsters stablecoin reserves, fostering trust.

Secondly, Bitcoin’s diversification benefits shine. Its low correlation with traditional assets makes it an ideal portfolio enhancer amid inflation and geopolitical risks.

Institutions like JPMorgan increased their ETF holdings by 64%, recognising Bitcoin as “digital gold.” Their ETF holdings by 64%, recognising Bitcoin as “digital gold”.

Moreover, technological integrations amplify appeal. Real-world asset tokenisation (RWA) and AI-driven protocols merge Bitcoin with decentralised finance (DeFi), projecting billions in value.

Thus, a sizeable number of institutions surveyed by Coinbase express bullishness for the next six months.

These drivers collectively position Bitcoin for sustained growth.

How This Surge Alters Bitcoin Market Dynamics

Institutions reshape Bitcoin’s ecosystem profoundly. They reduce available supply, as corporate treasuries lock away coins. This scarcity, combined with steady demand, dampens volatility and supports price floors. For example, ETFs now hold 28% of Bitcoin, up from 20% earlier in 2025.

Moreover, institutional inflows decouple Bitcoin from retail cycles. Unlike past bull runs driven by speculation, 2026 could see structured demand from pensions and registered investment advisors (RIAs).

This evolution transforms Bitcoin into a macro asset, integrated into 401(k)s and wealth portfolios. As a result, market maturity increases, attracting even conservative players.

Bitcoin Projections for 2026 and the Long-Term Horizon

Analysts forecast robust growth. Standard Chartered predicts $150,000 by 2026, driven by Fed policies and ETF flows.

Bitwise envisions up to $426.9 billion in inflows, acquiring over 4.2 million BTC.

UTXO Management’s optimists predict an injection of over $400 billion into Bitcoin by year-end 2026.

Beyond 2026, Bitcoin could hit $250,000 if demand surges through the decade.

Factors like U.S. Treasury collateralization with Bitcoin and global liquidity injections—such as the Fed’s $500 billion buybacks—fuel this optimism.

Therefore, institutions pave the way for Bitcoin’s role as a reserve asset, potentially rivalling gold.

Navigating Potential Challenges and Risks

Despite positives, hurdles loom. Volatility remains a concern; Bitcoin’s price dipped amid 2025 corrections, influenced by macro events like Fed decisions. Regulatory reversals or trade wars could deter inflows.

Additionally, centralisation risks arise if holdings are concentrated in a few hands, challenging Bitcoin’s decentralised ethos.

Mass liquidations might trigger downturns. However, diversified adoption mitigates these, as seen in privacy enhancements and multi-asset strategies.

Investors must balance enthusiasm with risk management.

Why Institutional Surge Spells Opportunity for BTC Investors

In conclusion, the institutional BTC holdings surge actively signals a bullish trajectory for 2026 and beyond.

By enhancing legitimacy, reducing supply, and integrating BTC into global finance, institutions drive long-term value.

Projections point to significant price appreciation, supported by regulatory tailwinds and innovative tech.

Yet, savvy investors monitor risks closely.

Ultimately, this shift positions BTC as an essential asset—embrace it strategically for future gains.