Recently, while crypto became trendy, global economic uncertainty, geopolitical tensions, and evolving financial technologies have sparked debates about the future of the US dollar as the world’s dominant currency.

With rising inflation, ballooning national debt, and increasing distrust in centralised financial systems, many individuals and investors are exploring alternatives like gold and cryptocurrencies.

But are people really shifting away from the US dollar in favour of these assets? Or, is this a temporary trend driven by market speculation?

In this article, Crypto Guide GH explores the factors driving interest in gold and crypto. We will also look at the challenges facing the US dollar and whether a significant shift is underway.

The US Dollar’s Dominance before Crypto: A Historical Perspective

Since the 1944 Bretton Woods Agreement, the US dollar has anchored global finance as the world’s primary reserve currency. Fuelled by America’s economic and military might, it leads international trade, drives oil pricing through the petrodollar system, and commands foreign exchange reserves.

According to the International Monetary Fund (IMF), as of 2024, approximately 58% of global foreign exchange reserves are held in US dollars. While this statistic is impressive, it remains a far cry from the more than 71% control greenback had in the market since the start of the 21st century.

Despite its dominance, signs of weakness are emerging. The US national debt surpassed $35 trillion in 2024. Interest payments are projected to reach $1 trillion annually by 2030.

Persistent inflation, driven by supply chain disruptions and expansive monetary policies, has eroded the dollar’s purchasing power.

Gold: Is Bitcoin a Threat to Gold as a Store of Value as it Recrosses $100,000

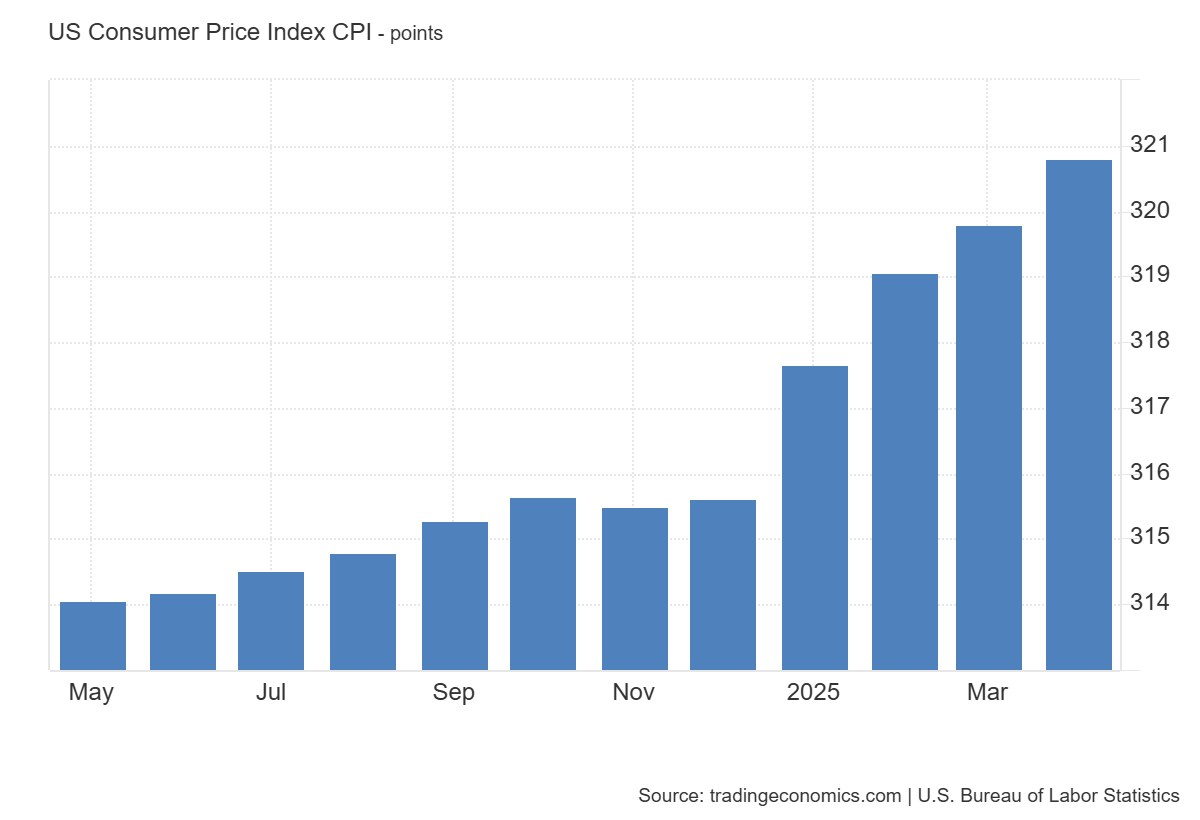

The Consumer Price Index (CPI) reached a peak of 320.79 in April 2025. This prompted fears of further devaluation.

These factors, combined with geopolitical shifts, have fuelled speculation that the dollar’s reign may be waning.

Why Gold? The Timeless Safe Haven

For thousands of years, people have valued gold as a store of wealth. The precious metal is prized for its scarcity, durability, and universal appeal.

During economic turmoil, gold actively shields investors from inflation and currency devaluation.

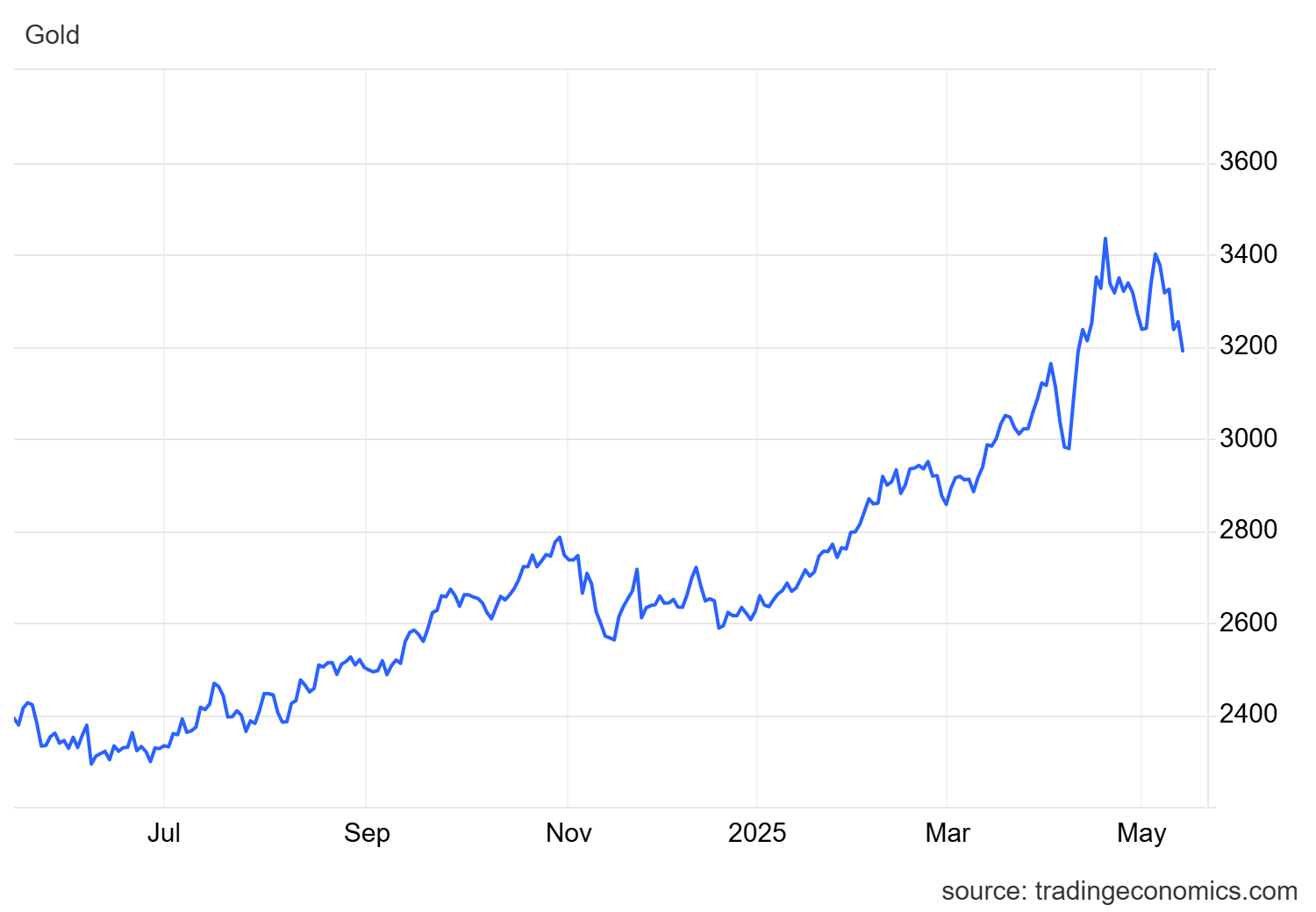

Since the recovery of the financial markets from its plunge in 2020, gold prices have surged. It reached an all-time high of $3,500 per ounce in April 2025.

Central banks, especially in China, India, and Russia, are aggressively accumulating gold. This has led to a substantial rise in global purchases. According to the World Gold Council, central banks added 1,045 tonnes to global gold reserves in 2024.

Investors are drawn to gold because of its tangible nature and independence from central control.

Unlike fiat currencies, which governments can print freely, gold’s limited supply ensures its reliability as a wealth protector during crises.

The dedollarisation efforts of BRICS nations (Brazil, Russia, India, China, and South Africa) have further boosted gold’s appeal. These countries, led by Russia and China, are exploring gold-backed trade mechanisms to lessen their reliance on the dollar.

However, gold is not without drawbacks. It generates no yield, incurs storage costs, and is less liquid than digital assets. Despite these limitations, its historical resilience keeps it a cornerstone of diversified portfolios, particularly as trust in fiat currencies falters.

The Rise of Crypto Assets: A Digital Revolution

Cryptocurrencies, led by Bitcoin and Ethereum, have emerged as a decentralised alternative to traditional finance.

Bitcoin, actively dubbed digital gold by analysts, is gaining traction as a hedge against inflation and government overreach.

Its fixed supply cap of 21 million coins reflects the scarcity of gold, appealing to investors wary of fiat currency debasement.

In 2025, Bitcoin hit a record high of $109,114. The coin’s recent surge is actively driven by institutional adoption and the approval of Bitcoin ETFs in multiple countries.

Crypto’s appeal lies in its borderless nature, transparency, and resistance to censorship. Blockchain technology ensures secure, immutable transactions, bypassing intermediaries like banks.

Younger generations and tech-savvy investors have taken to digital assets. In regions with unstable currencies like Venezuela and Zimbabwe, millions have embraced cryptocurrencies, driving a surge in adoption.

Yet, cryptocurrencies face significant hurdles. Volatility remains a concern. Bitcoin and other alternate coins (altcoins) can experience multiple percentage losses within a short period.

Regulatory uncertainty also looms. Despite breakthroughs in some parts of the world, many governments continue to crack down on crypto exchanges by imposing stricter tax policies.

Environmental concerns surrounding energy-intensive Proof-of-Work (PoW) mining processes have further tarnished crypto’s reputation.

Despite these challenges, the global crypto market cap reached $3.4 trillion in May 2025, signalling robust demand.

Is the US Dollar Being Dumped?

The notion of “dumping” the US dollar implies a mass exodus, which oversimplifies the situation. While gold and crypto are gaining traction, the dollar remains deeply entrenched.

It accounts for more than 50% of global transactions, according to the Society for Worldwide Interbank Financial Telecommunication (SWIFT). It is also the currency of choice for global debt issuance. The dollar’s liquidity, stability, and network effects make it difficult to replace overnight.

However, signs of erosion are evident. Countries like China and India are increasingly settling trade in local currencies, such as the Renminbi (Yuan) and Rupee.

The BRICS bloc is actively discussing a gold-backed currency to challenge the dollar’s hegemony. Meanwhile, retail investors are diversifying into gold and crypto. Approximately 65 million people in the United States own cryptocurrencies – a quarter of the adult population. These trends suggest a gradual shift rather than an outright abandonment.

Sanctions have also accelerated dedollarisation. The US’s weaponisation of the dollar—freezing Russia’s foreign reserves in 2022, amid the country’s war with Ukraine—prompted nations to seek alternatives.

This has driven demand for gold and crypto, as well as experiments with central bank digital currencies (CBDCs). China’s digital yuan, for instance, is gaining traction in cross-border trade.

Cryptocurrency Wars: Is It Better to Buy a Crypto ETF or Hold the Real Coin?

Challenges and Risks of Shifting to Gold and Crypto

While gold and crypto offer compelling alternatives, they are not without risks. Gold’s price is subject to market speculation, and its physical nature makes it cumbersome for everyday transactions.

Cryptocurrencies, meanwhile, are prone to hacks, scams, and regulatory clampdowns. The collapse of major exchanges like FTX and stablecoins like Terra LUNA in 2022 shook investor confidence, highlighting the sector’s vulnerabilities.

Moreover, neither asset can fully replicate the dollar’s role in global trade and finance. Gold lacks scalability for modern economies, while cryptography’s decentralised nature complicates its use in regulated systems.

That said, the dollar’s entrenched infrastructure, which comprises banking networks, payment systems, and legal frameworks, gives it a formidable edge.

The Future: Diversification, Not Domination

The shift toward gold and crypto reflects a broader trend of diversification rather than a complete rejection of the US dollar.

Investors are actively hedging against uncertainty, fueled by rising inflation, growing debt, and escalating geopolitical risks.

Central banks are bolstering gold reserves, while retail investors are embracing crypto’s potential.

However, the dollar’s dominance is unlikely to collapse in the near term, given its deep-rooted infrastructure and global trust.

However, the emergence of gold and cryptocurrency signifies a significant paradigm shift. As technology advances and geopolitical alliances evolve, the financial landscape is becoming more fragmented.

Dedollarization efforts, coupled with innovations like CBDCs and the blockchain, could gradually erode the dollar’s monopoly. For now, gold and crypto serve as complementary assets, offering resilience in an uncertain world.

Bitcoin $2 Trillion Market Capitalisation Has Surpassed Meta, Tesla, and Google

Conclusion: Have crypto and gold taken over the US dollar as the world’s reserve currency?

Are people shifting to gold and crypto and dumping the US dollar? While the shift is not complete, the trend towards alternative assets is undeniable.

Economic instability, technological innovation, and geopolitical manoeuvring are driving interest in alternative assets.

Gold’s timeless stability and crypto’s disruptive potential make them attractive hedges, but the dollar’s entrenched role ensures its resilience—for now.

As the global economy evolves, diversification will likely define the future, with gold, crypto, and fiat currencies coexisting in a multipolar financial system.

VIRTUAL Protocol Crypto: You Missed the 44,000% Gains; Don’t Miss the Upcoming Opportunities