In the fast-evolving world of cryptocurrencies, NFT sales volume serves as a vital indicator of blockchain health and user engagement.

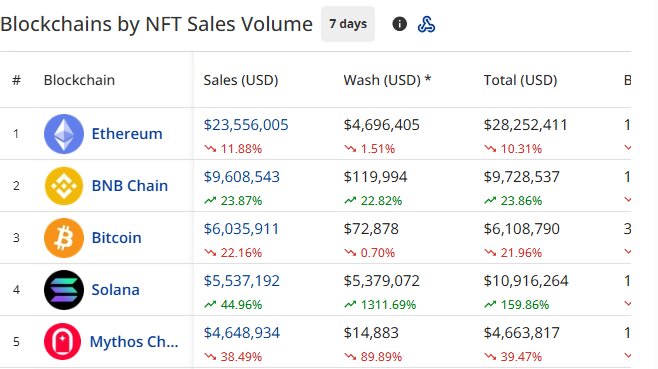

During Week 2 of December 2025 (December 8-14), the NFT market showcased remarkable activity, with top blockchains driving millions in transactions.

Ethereum dominated the leaderboard, followed closely by BNB Chain, Bitcoin, Solana, and Mythos Chain.

These figures not only highlight shifting trends but also show the growing integration of NFTs into digital economies.

Moreover, understanding these rankings helps investors and creators navigate opportunities.

This article dives deep into the data, explains the reasons behind each blockchain’s performance, and explores why these metrics matter to the broader crypto community.

Ethereum Blockchain Tops the Charts with $23.56 Million in Sales

Ethereum actively leads the NFT space, recording an impressive $23,556,005 in sales volume during the week.

Developers flock to Ethereum because it pioneered smart contracts, enabling seamless NFT creation and trading.

For instance, platforms like OpenSea thrive on their robust ecosystem, attracting artists and collectors alike.

Additionally, Ethereum’s recent upgrades, such as improved scalability, reduce gas fees and enhance user experience.

However, competition from faster chains challenges its dominance, yet its established community ensures sustained leadership.

Traders benefit from Ethereum’s liquidity, making it a go-to for high-value digital art and collectibles.

BNB Chain Secures Second Place at $9.61 Million

BNB Chain surges ahead with $9,608,543 in NFT sales, demonstrating its appeal for cost-effective transactions.

Users choose BNB Chain for its low fees and high speed, which stem from its compatibility with Ethereum tools while offering better efficiency.

Moreover, the chain hosts more than 300 gaming projects, fuelling NFT demand in virtual worlds.

Creators actively mint NFTs on marketplaces like those integrated with Binance, drawing in a diverse user base.

Therefore, BNB Chain’s interoperability with other ecosystems amplifies its growth, positioning it as a bridge for newcomers entering the NFT market.

This performance signals BNB Chain’s evolution from a niche player to a mainstream contender.

You can start off by trading Binance NFTs by signing up here.

Bitcoin Blockchain Claims Third Spot with $6.04 Million

Bitcoin innovates in the NFT arena through Ordinals, achieving $6,035,911 in sales volume.

Collectors embrace Bitcoin Ordinals because they inscribe data directly onto satoshis, creating unique digital assets without smart contracts.

For example, marketplaces like Magic Eden facilitate easy buying and selling, boosting accessibility.

Additionally, Bitcoin’s security and scarcity appeal to investors seeking long-term value.

However, its slower transaction speeds compared to rivals limit mass adoption.

Nevertheless, this week’s figures illustrate Bitcoin’s expanding role beyond currency, as Ordinals attract traditional crypto holders into NFTs.

Solana Ranks Fourth at $5.54 Million

Solana accelerates NFT trading with $5,537,192 in sales, thanks to its lightning-fast processing and minimal costs.

Developers build on Solana because it handles thousands of transactions per second, ideal for high-volume NFT drops.

Moreover, vibrant marketplaces such as Tensor and Magic Eden host popular collections, engaging a youthful, tech-savvy audience.

Therefore, Solana’s focus on scalability addresses pain points in other chains, fostering innovation in art and gaming NFTs.

However, network congestion in peak times occasionally hampers reliability.

Overall, Solana’s performance in Week 2 highlights its resilience amid market fluctuations.

Mythos Chain Rounds Out the Top Five with $4.65 Million

Mythos Chain emerges strongly in fifth place, posting $4,648,934 in NFT sales, primarily driven by gaming integrations.

Gamers actively participate because Mythos specialises in blockchain gaming, with platforms like DMarket enabling in-game asset trades.

For instance, its Polkadot-based architecture ensures interoperability, allowing seamless cross-game NFT use.

Additionally, Mythos’s focus on user-friendly tools attracts developers building immersive experiences.

Therefore, this chain’s rise reflects the booming intersection of gaming and crypto, where NFTs represent virtual ownership.

Why NFT Sales Volume Matters to the Crypto Community

NFT sales actively drive blockchain adoption by creating tangible value for digital assets.

Communities thrive as these transactions foster engagement, with creators earning royalties and users building portfolios.

Moreover, high volumes signal market confidence, attracting institutional investors and mainstream brands.

For example, NFTs revolutionise industries like art and gaming, generating new revenue streams.

However, fluctuations remind participants of risks, encouraging diversified strategies.

Therefore, tracking sales empowers the community to identify trends, such as shifts toward gaming-focused chains like Mythos.

NFT Blockchain Broader Implications for Investors and Creators

Investors monitor these rankings because they reveal ecosystem vitality; Ethereum’s lead offers stability, while emerging chains like Mythos promise high growth.

Creators, meanwhile, select platforms based on fees and audience sizes to maximise reach.

Additionally, these metrics influence token prices, as robust NFT activity boosts underlying cryptocurrencies.

Future Trends in NFT Blockchains

Looking ahead, experts predict increased interoperability among chains, potentially blurring current rankings.

Moreover, advancements in layer-2 solutions could elevate sales volumes further.

Therefore, staying informed on weekly data equips the community for upcoming shifts.

Conclusion: NFTs as a Pillar of Crypto Evolution

In summary, Week 2 of December 2025’s NFT sales shows Ethereum’s dominance while spotlighting challengers like BNB Chain and Mythos.

These blockchains actively shape the crypto landscape by enabling ownership, innovation, and economic opportunities.

As the market matures, NFT volumes will continue to reflect community health, driving widespread adoption.

Whether you’re an investor or creator, these insights provide a roadmap for navigating the dynamic world of digital assets.