Experts predicted that the digital collectibles market would reach its peak in 2021 and 2022 due to the support of Bitcoin NFT.

Fortunately, the predictions of most analysts have come true, as Bitcoin NFTs have contributed their quotas to seeing NFT global sales top $70 billion.

The Bitcoin blockchain has transformed itself from being seen as a layer-one technology to becoming one of the most patronised protocols within the space. The BTC chain has emerged as a transformative force in the digital collectibles space.

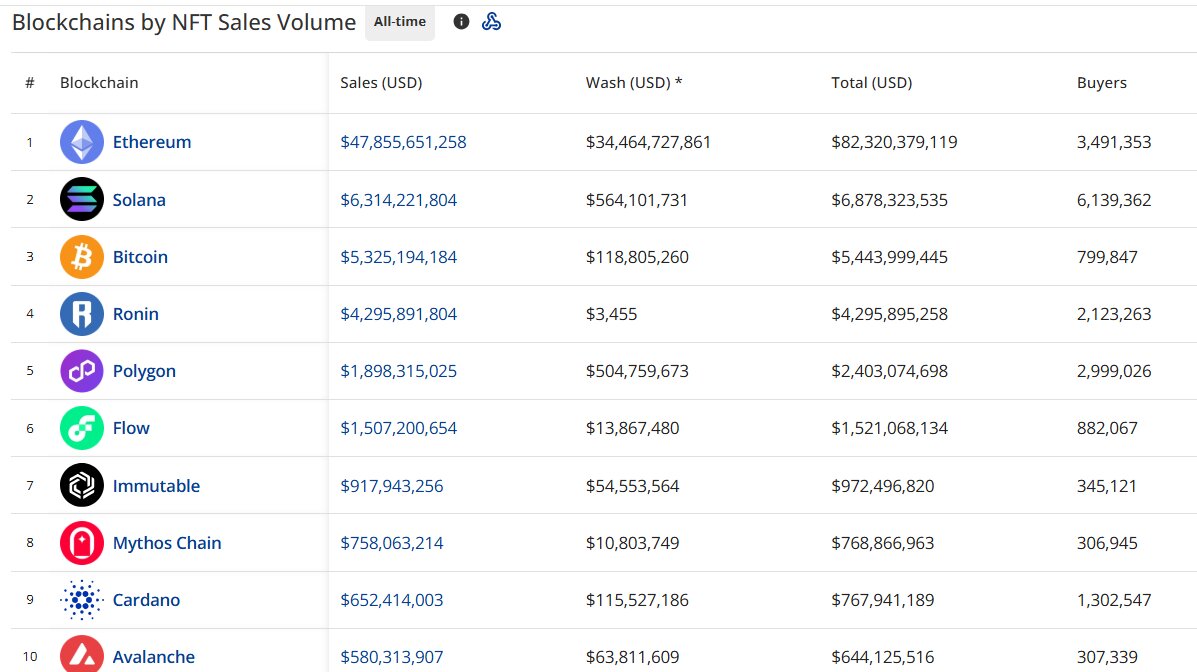

While Ethereum has long dominated NFT trading, Bitcoin’s secure and decentralised network, coupled with innovations like Ordinals, has positioned it as a compelling platform for NFTs.

In this article, Crypto Guide GH explores Bitcoin’s growing role in the NFT ecosystem. We will look at what makes Bitcoin NFT unique and their potential to drive market recovery.

The Rise of Bitcoin NFT

The man known by the pseudonym Satoshi Nakamoto launched Bitcoin in 2009. Bitcoin is renowned for its robust security and decentralised architecture.

Bitcoin historically aimed to rival fiat currencies like the USD, EUR, GBP, and YEN by actively facilitating financial transactions.

Over the past three years, the introduction of the Ordinal Protocol in 2022 revolutionised Bitcoin’s utility by enabling NFTs.

Ordinals allow unique digital assets, such as images, videos, or collectibles, to be inscribed directly onto the smallest Bitcoin units, which are collectively called satoshis. This creates Bitcoin-native NFTs.

Unlike Ethereum-based NFTs, which rely on token standards like Ethereum Request for Comment (ERC)-721, Ordinals are inherently tied to Bitcoin’s blockchain.

This capability offers the crypto collectibles unmatched security and permanence. SkyQuest Technology valued the NFT market at around $36 billion in 2023.

At the time, the research company cited renewed interest in digital ownership and blockchain innovation as primary drivers.

After the 2023 bear market that saw NFT trading volumes drop significantly, Bitcoin’s entry into the NFT space signalled a potential catalyst for recovery.

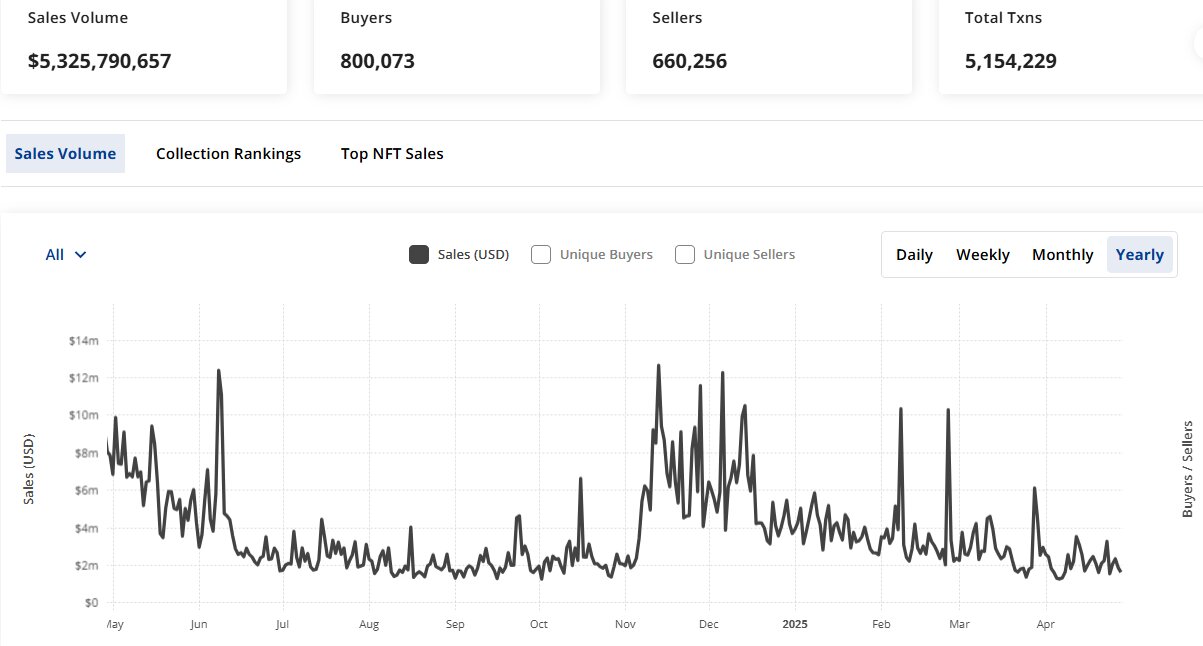

CryptoSlam data shows that Bitcoin NFT sales have reached approximately $5.3 billion. Much of this statistic came from projects like Uncategorised Ordinals, NodeMonkes, RuneStone, Bitcoin Puppets, and Quantum Cats, which have contributed their quota towards overall NFT sales volume.

Also Read: Cryptocurrency Wars: Is It Better to Buy a Crypto ETF or Hold the Real Coin?

Why Bitcoin NFT?

Unparalleled Security

Bitcoin’s blockchain is the most secure, decentralised network in existence. Bitcoin has survived the threats of centralised financial institutions as well as regulatory agencies for more than 15 years of uninterrupted operation.

This robustness ensures that Bitcoin-based NFTs, or Ordinals, are tamper-proof and resistant to hacks. This trait is a key factor as the NFT market rebuilds trust post-2023 volatility.

Unlike other blockchains, Bitcoin’s Proof-of-Work (PoW) consensus algorithm minimises the risk of network disruptions. This benefit makes it ideal for high-value digital assets.

Intrinsic Value of Satoshis

Ordinals stand out due to their backing by actual satoshis, the smallest denomination of Bitcoin. This intrinsic value means Bitcoin NFT cannot theoretically reach zero monetary worth. This conclusion is contrary to more than 85% of Ethereum-based NFTs and Solana NFTs, which have been reported valueless.

As Bitcoin’s price reaches a new milestone in 2025 and beyond, the value proposition of satoshi-backed NFTs will strengthen. The increased value will attract investors seeking assets with lasting significance.

Scalability through Layer 2 Solutions

Bitcoin’s Layer 2 (L2) solutions, such as the Lightning Network and emerging platforms like Botanix, enhance its scalability for NFT trading.

These L2s enable faster, low-cost transactions while maintaining Bitcoin’s security. By 2025, Bitcoin L2s are expected to host 100,000 BTC in total value locked (TVL). The system will support decentralised finance (DeFi) and NFT marketplaces.

Cultural and Historical Appeal

Bitcoin’s status as the original cryptocurrency adds cultural weight to its NFTs.

Collections like Bitmap, which tokenise Bitcoin blocks as digital real estate, tap into Bitcoin’s historical narrative. This appeals to collectors and investors.

As cryptocurrency wealth rebounds, affluent users are diversifying into Bitcoin NFT for their speculative and cultural value.

Stay Informed: Cryptocurrencies: Top 5 Reasons Why You Should Invest in Crypto Assets in 2025

Challenges and Future Outlook on Bitcoin NFT

Bitcoin NFT adoption faces hurdles. Among these challenges is the lack of smart contract functionality in comparison to Ethereum. Aside from this, there is a higher development complexity for Ordinals.

However, advancements in Bitcoin L2s and tools like Botanix, which enable Ethereum-like DeFi and NFT capabilities, are bridging this gap.

The projected $4 trillion in decentralised exchange (DEX) volumes by the end of 2025, led by SuperEx and Uniswap, will likely include Bitcoin-based NFT trading.

Institutional interest actively fuels such activity, driving broader market recovery in the blockchain-based economy.

More: Is Bitcoin (BTC) A Threat to Gold As A Store of Value After the Coin Surpassed $100K?

Conclusion: Should you buy Bitcoin NFT?

The Bitcoin blockchain actively drives immense potential in the NFT market through its security, intrinsic value, and expanding infrastructure.

As the NFT market eyes above-average sales in 2025, Bitcoin’s Ordinals and L2 solutions position it as a leader in digital collectibles.

Investors and creators should explore platforms like Magic Eden’s Bitcoin Ordinals Marketplace to capitalise on this emerging trend, signalling a new era for NFTs on the world’s most trusted blockchain.

1 Comment

Pingback: Will Metaplanet Bitcoin Surge Shake Up the Crypto World and Take BTC to $200,000? » CyptoGuide Ghana