Bitcoin miners actively secure the network by validating transactions and adding new blocks, earning revenue primarily from block subsidies and transaction fees.

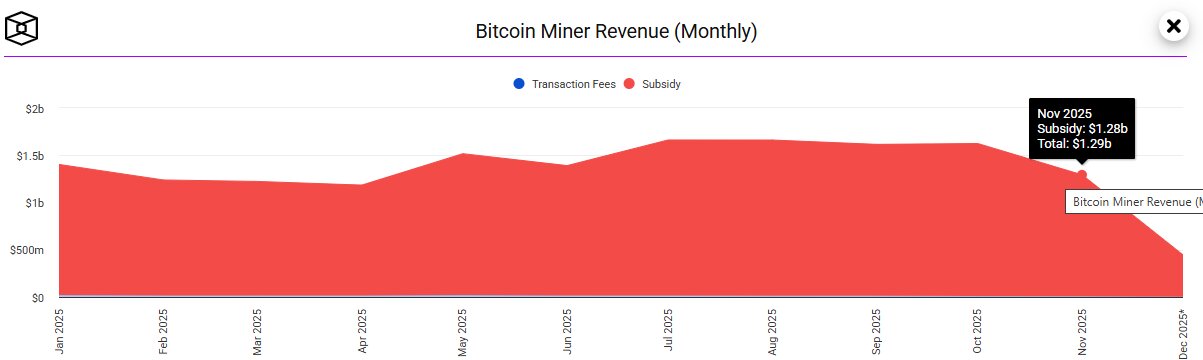

In November 2025, miners generated $1.29 billion in total revenue.

Moreover, this figure reflects resilience amid market volatility.

It represents a drop from October’s better showing, though.

This article analyses November’s data, compares key periods, and explains why miner revenue serves as a critical barometer for crypto miners’ sustainability and Bitcoin’s overall fortunes.

November 2025 Bitcoin Revenue Hits $1.29 Billion

Miners collected $1.29 billion throughout November 2025, combining fixed block rewards with variable fees.

Operators maintain operations despite fluctuating BTC prices, as revenue supports energy costs and hardware investments.

Additionally, sustained earnings encourage network participation, which bolsters decentralisation.

Therefore, this billion-dollar monthly haul demonstrates mining’s ongoing economic viability.

Year-Over-Year Growth from November 2024’s $1.21 Billion

November 2025 revenue rose modestly to $1.29 billion, surpassing November 2024’s $1.21 billion.

Miners benefit from higher average BTC prices and improved efficiency post-halving adjustments.

Moreover, growing adoption drives more transactions, occasionally spiking fees.

However, this year-over-year (YoY) increase signalled recovery and confidence as miners expanded capacity despite challenges.

Decline from October 2025’s Peak of $1.62 Billion

Revenue drops noticeably from October 2025’s $1.62 billion to November’s $1.29 billion.

Traders experience BTC price corrections, reducing the USD value of rewards.

Additionally, lower network congestion led to subdued transaction fees.

Therefore, this month-over-month (MoM) dip highlights mining’s sensitivity to short-term market swings, prompting operators to hedge costs.

Factors Driving Bitcoin Miner Revenue Fluctuations

Block subsidies remain constant post-2024 halving at 3.125 BTC per block, but USD revenue varies with price. Fees contribute dynamically during high-activity periods.

Moreover, record hash rates increase competition, diluting individual shares.

However, efficient miners with low electricity costs thrive, maintaining profitability.

Why Miner Revenue Matters to Crypto Miners

Strong revenue enables miners to cover operational expenses, upgrade equipment, and accumulate BTC holdings.

Weak periods strain smaller operators, potentially leading to consolidation.

Additionally, revenue trends influence stock prices for public mining firms.

Therefore, strong profits promote industry growth and innovation in sustainable energy use.

Direct Impact on Bitcoin (BTC)’s Price and Network Security

High miner revenue correlates with elevated BTC prices, as rewards attract hashing power.

Robust security deters attacks, fostering trust. Moreover, miners selling newly minted BTC can pressure prices during lows.

However, accumulated holdings often signal bullish conviction, stabilising supply.

Network Security and Hash Rate Implications

Elevated revenue incentivises more miners to join, pushing hash rates higher and improving security.

Conversely, it drops risk outflows, temporarily softening the difficulty.

Additionally, Bitcoin’s proof-of-work (PoW) model relies on this economic alignment for longevity.

Broader Crypto Ecosystem Benefits

Miner activity distributes new BTC predictably, countering inflation.

Communities gain from secure infrastructure supporting decentralised finance (DeFi), non-fungible tokens (NFTs), and Layer 2 solutions.

Moreover, mining’s energy demands drive renewable integrations, aligning with global sustainability goals.

Challenges in Volatile Markets

Price crashes compress margins, forcing sales of reserves. Regulatory shifts and energy prices add uncertainty.

However, adaptive strategies like artificial intelligence (AI) pivots diversify income streams.

Opportunities for Future Growth

Rising institutional interest and exchange-traded fund (ETF) inflows could boost demand.

Halving cycles historically precede bull runs, amplifying revenue.

Therefore, long-term holders view dips as accumulation phases.

Investor and Miner Strategies

Diversify operations geographically for cheap power. Monitor on-chain metrics for early signals.

Additionally, public miners offer indirect exposure via stocks.

Conclusion: Bitcoin Miner Revenue as a Vital Crypto Pulse

November 2025’s $1.29 billion revenue—up year-over-year from $1.21 billion yet down from October’s $1.62 billion—shows mining’s pivotal role.

Miners actively safeguard Bitcoin while influencing its price through supply dynamics.

As revenue sustains operations, it fortifies network security, drives adoption, and signals market health.

For the entire crypto community, robust miner economics promise continued innovation, resilience, and growth in Bitcoin’s decentralised future.