In recent years, Bitcoin has undergone a remarkable transformation. It has evolved from a niche digital experiment to a global financial phenomenon.

Surprisingly, its market capitalisation has surged to flip that of some of the world’s most prominent corporations.

Consequently, this seismic shift prompts a deeper exploration of Bitcoin’s rise and its implications for traditional finance (TradFi) as well as the factors driving its unprecedented valuation.

To fully grasp this development, let’s examine Bitcoin’s journey. By reading this in its entirety, CryptoGuide GH compares BTC’s market cap to major corporations and considers the broader economic context.

VIRTUAL Protocol Crypto: You Missed the 44,000% Gains; Don’t Miss the Upcoming Opportunities

The Meteoric Rise of Bitcoin

Initially launched in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin introduced a decentralised digital currency free from central bank control.

At first, it was a curiosity for technology enthusiasts, with negligible value. However, over the next 16 years, its adoption has grown exponentially.

For instance, by 2017, Bitcoin’s price had climbed to nearly $20,000. This demonstrated its potential as a valuable asset.

Fast forward to 2025, and Bitcoin’s price has soared to new heights, frequently exceeding $100,000 per coin. Institutional adoption, technological advancements, and macroeconomic trends are among its price drivers.

As a result, Bitcoin’s market capitalisation—calculated by multiplying its circulating supply by its current price—has reached staggering levels.

Currently, with approximately 19 million coins in circulation, Bitcoin’s market cap hovers around $2 trillion.

To put this into perspective, this figure rivals or surpasses the valuations of corporate giants like Tesla, Google, and Meta Platforms Inc. at various points in their histories, as of this publication.

Thus, Bitcoin’s ascent is not merely a financial curiosity but a paradigm shift challenging traditional notions of value.

Bitcoin vs. Corporate Giants

To illustrate Bitcoin’s dominance, let’s compare its market cap to that of major corporations.

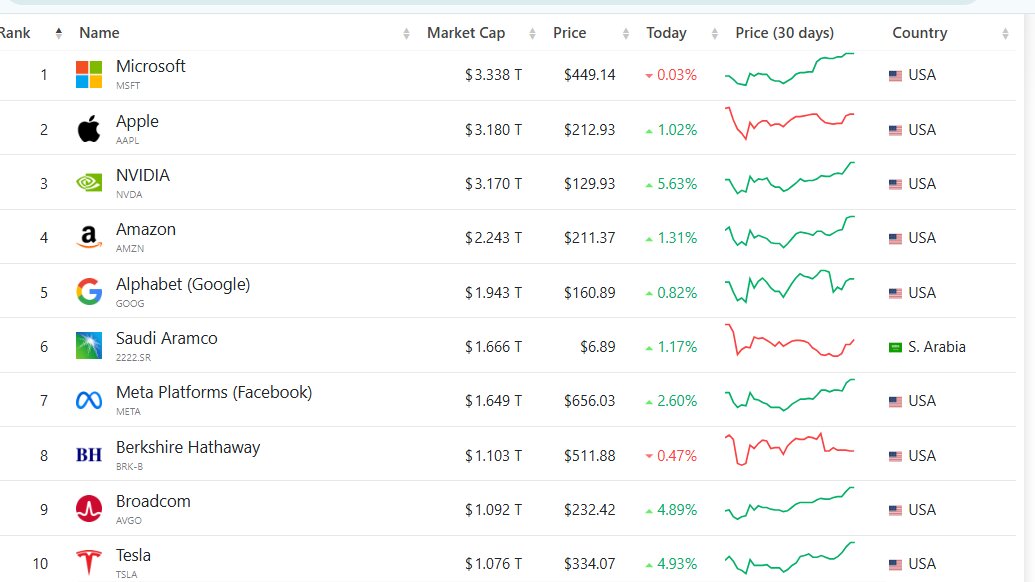

As of this writing, Apple’s market capitalisation stands at approximately $3.2 trillion, whereas Microsoft’s is around $3.3 trillion.

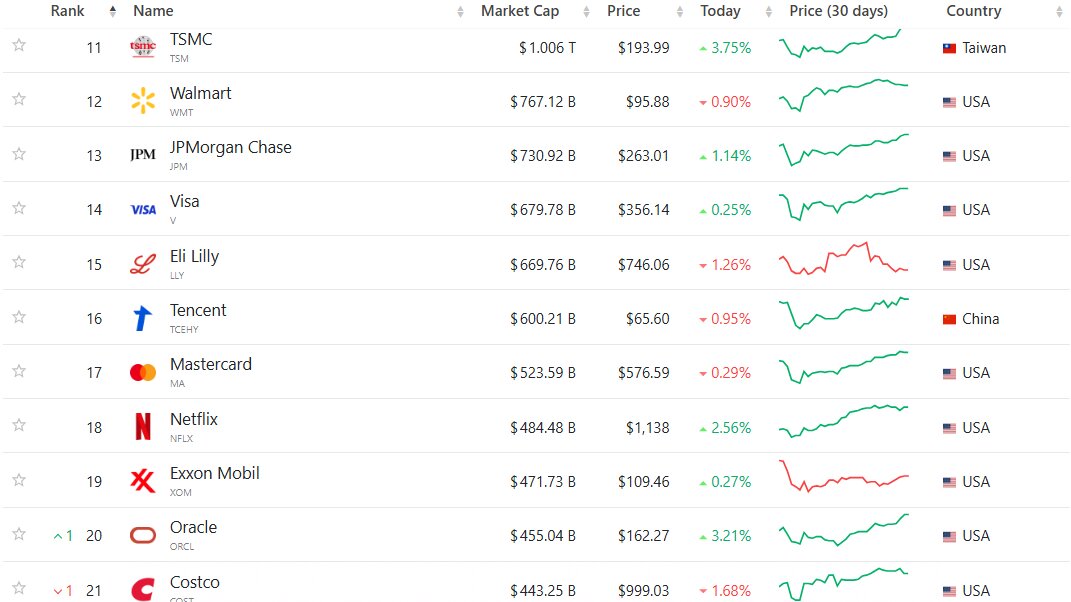

Meanwhile, Bitcoin’s $2 trillion market cap has eclipsed companies like Tesla ($1.06 trillion), Meta ($1.64 trillion), Google ($1.9 trillion), and Walmart ($767 billion).

Additionally, it has outstripped the valuations of legacy financial institutions such as JPMorgan Chase ($730 billion), Visa ($679 billion), and Mastercard.

This comparison underscores a critical point: Bitcoin, a decentralised asset with no physical headquarters or tangible products, now commands a valuation rivalled by industry titans.

Moreover, Bitcoin’s growth trajectory differs fundamentally from that of corporations. While companies rely on revenue streams, product innovation, and operational efficiency, Bitcoin’s value stems from scarcity, network effects, and investor sentiment.

Specifically, its fixed supply cap of 21 million coins creates a scarcity akin to digital gold. Consequently, as demand rises—fuelled by institutional investors, hedge funds, and retail adoptions—its price surges, propelling its market cap to new heights.

Factors Driving Bitcoin’s Valuation

Several key factors have contributed to Bitcoin’s meteoric rise.

First and foremost, institutional adoption has played a pivotal role. For instance, companies like MicroStrategy and Tesla have added Bitcoin to their balance sheets, signalling confidence in its long-term value.

Similarly, major financial institutions, including Fidelity and BlackRock, now offer Bitcoin-related investment products such as exchange-traded funds (ETFs). This has gone a long way towards legitimising cryptocurrencies.

As a result, these developments have attracted billions in capital inflows, boosting Bitcoin’s market cap.

Secondly, macroeconomic conditions have favoured Bitcoin’s growth. In particular, persistent inflation and currency devaluation have eroded trust in fiat currencies.

For example, in 2022–2023, global inflation rates soared in large part due to the crisis brought forth by the Russia/Ukraine war. This prompted investors to seek alternative stores of value.

Bitcoin, often dubbed “digital gold,” has benefited from this trend, as its decentralised nature shields it from government manipulation. Therefore, investors view it as a hedge against economic uncertainty, driving demand and valuation.

Additionally, technological advancements have bolstered Bitcoin’s appeal. The Lightning Network, for instance, has enhanced Bitcoin’s scalability, enabling faster and cheaper transactions.

Such growth has seen the flagship cryptocurrency, which was only known for its transactional value, branch into others in the Web3 economy.

Bitcoin NFTs have become a major player within the digital collectibles space. As of this writing, it had surpassed $5 billion in all-time sales. The milestone has made Satoshi Nakamoto’s innovation the third-largest NFT blockchain by all-time volume.

Likewise, improvements in wallet security and user-friendly interfaces have lowered barriers to entry for retail investors. Consequently, these innovations have broadened Bitcoin’s use cases from peer-to-peer payments to long-term investment, further fuelling its market cap growth.

Bitcoin NFT Sales Surpass Ronin, Now 3rd Largest Chain by All-Time Volume

Implications for Traditional Finance

Bitcoin’s rise poses profound implications for the global financial system. On one hand, it challenges the dominance of traditional corporations and financial institutions.

For example, as Bitcoin’s market cap surpasses that of banks like JPMorgan, it signals a shift in how value is perceived and stored.

Unlike corporations, which are subject to regulatory oversight and economic cycles, Bitcoin operates on a decentralised blockchain, making it immune to many traditional risks. Thus, it’s growing prominence forces businesses to rethink their strategies in a crypto-driven world.

On the other hand, Bitcoin’s success highlights the limitations of centralised financial systems. Specifically, its ability to function without intermediaries—such as banks or payment processors—appeals to those disillusioned with bureaucracy and fees.

Moreover, its borderless nature facilitates cross-border transactions, making it a viable alternative to legacy systems like SWIFT. As a result, corporations and governments are increasingly exploring blockchain technology to remain competitive.

However, Bitcoin’s rise is not without challenges. For instance, its volatility remains a concern, with price swings of 20–30% within a short period.

Additionally, regulatory uncertainty looms large, as governments grapple with how to tax and regulate cryptocurrencies.

Nevertheless, these hurdles have not deterred investors, as evidenced by Bitcoin’s relentless market cap growth.

The Broader Economic Context

To fully understand Bitcoin’s valuation, we must consider the broader economic landscape.

Recently, global markets have faced unprecedented disruptions, from pandemics to geopolitical tensions.

Consequently, investors have sought safe-haven assets to preserve wealth. While gold and real estate remain popular, Bitcoin has emerged as a modern alternative, particularly among younger generations.

For example, Gemini surveys indicate that Millennials and Gen Z are more likely to invest in cryptocurrencies than traditional stocks.

Furthermore, the rise of decentralised finance (DeFi) has amplified Bitcoin’s relevance. DeFi platforms, built on blockchain technology, offer lending, borrowing, and trading services without intermediaries.

Since Bitcoin serves as a foundational asset in many DeFi ecosystems, its value is intricately tied to the growth of this sector. As a result, the expansion of DeFi has indirectly boosted Bitcoin’s market cap.

Gold: Is Bitcoin a Threat to Gold as a Store of Value as it Recrosses $100,000

Looking ahead into the uncertain financial future

In conclusion, Bitcoin’s market capitalisation surpasses that of major corporations, marking a watershed moment in financial history.

Driven by institutional adoption, macroeconomic trends, and technological innovation, Bitcoin has redefined what it means to be a valuable asset.

Although challenges like volatility and regulation persist, its decentralised nature and fixed supply ensure its enduring appeal.

Moving forward, as more corporations and individuals embrace cryptocurrencies, Bitcoin’s market cap is poised to climb even higher, potentially reshaping the global economy.

Ultimately, its rise serves as a testament to the power of innovation and the evolving nature of value in the digital age.