In the vibrant Solana DeFi landscape, liquidity tokens like Jupiter Perps LP (JLP) emerge as essential drivers of yield and innovation. JLP captivates investors amid surging trading volumes.

Thus, as perpetual futures platforms redefine leveraged trading, JLP stands out for its role in powering Jupiter Exchange’s ecosystem.

Therefore, this comprehensive review scrutinises JLP’s fundamentals, risks, and projections to guide your decision-making.

Moreover, with Solana’s high-speed infrastructure enabling sub-second settlements, JLP bridges passive income with active market exposure.

As a result, yield seekers actively explore its potential in 2025’s evolving market.

Thus, whether you’re a DeFi novice or seasoned trader, this optimised guide delivers resourceful insights, from entry strategies to long-term forecasts, empowering you to assess if JLP fits your portfolio.

What Is JUPITER PERPS LP? A Simple Explanation

Jupiter Perps LP (JLP) serves as the core liquidity token for Jupiter Exchange’s perpetuals platform on Solana. This enables seamless leveraged trading while rewarding providers.

Specifically, users deposit assets like SOL, ETH, WBTC, and USDC into the JLP pool, which traders borrow for up to 250x leverage on pairs such as SOL/USDC.

In return, LPs capture 75% of trading fees, hourly borrow interest, and liquidation gains, generating yields without traditional impermanent loss.

Furthermore, JLP functions as a diversified basket, mirroring major cryptos while compounding value from platform activity.

Developers integrate it effortlessly via Pyth oracles for real-time pricing, ensuring low-slippage executions.

Additionally, upgrades like JLP Loans allow borrowing against holdings at 80% LTV, enhancing composability.

As of writing, Jupiter Perps LP (JLP) was exchanging hands for $4.7, bolstered by a minimum daily trading volume of $17 million throughout December 2025.

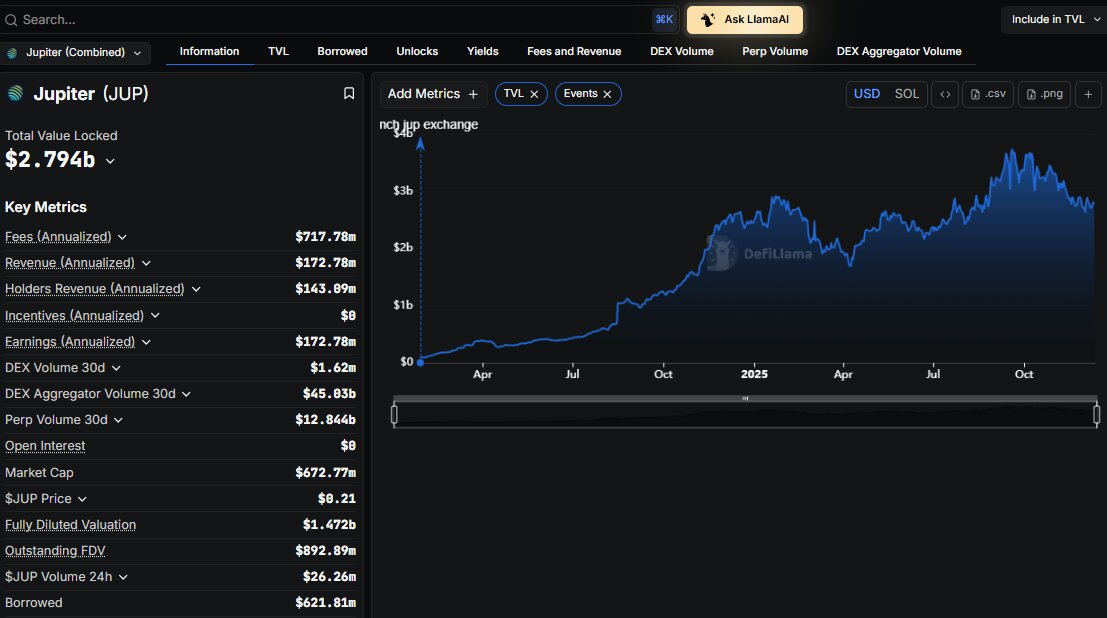

What’s more, the digital currency has commanded a market capitalisation of more than $1 billion throughout 2025, reflecting sustained investor confidence.

Supported by exchanges such as Orca, XT.COM, Raydium, CEX.IO, and Meteora, JLP trades fluidly across decentralised exchanges (DEXs) and centralised exchanges (CEXs).

In short, JLP transforms idle capital into a revenue engine, making DeFi accessible and profitable for everyday users. Hence, it embodies Solana’s ethos of speed and efficiency in perpetuals.

JUPITER PERPS LP Investing: Getting Started

Launching into JLP investment unfolds efficiently, drawing newcomers into Solana’s yield opportunities with minimal friction.

Initially, acquire a Solana wallet like Phantom, funding it via fiat ramps on MoonPay or Coinbase.

Next, head to Jupiter Exchange (jup.ag) and connect—navigate to the Perps LP interface to deposit balanced assets into the pool, minting JLP tokens instantly.

For secondary markets, trade on Raydium or Orca for DEX liquidity, or XT.COM and CEX.IO for centralised simplicity.

Once held, stake JLP for auto-accrue fees, or leverage loans for borrowing USDC at low APRs.

Moreover, monitor yields via Jupiter’s dashboard, where APYs often hover at 10-20%. Employ dollar-cost averaging during consolidations below $4.5 to mitigate volatility.

In essence, these steps actively harness JLP’s mechanics; secure your wallet and DYOR to maximise returns.

Is JUPITER PERPS LP a Good Investment?

JLP asserts itself as a strong investment through its yield-centric design and ecosystem ties.

Primarily, it delivers real revenue from Jupiter’s impressive quarterly volume, outshining speculative tokens. Moreover, Solana’s growth—fuelled by mobile DeFi—amplifies its appeal.

However, perp dependencies introduce swings, as a 10% volume dip could trim yields.

Thus, for yield-orientated portfolios, JLP excels; its $1 billion-plus market cap and $17M daily volumes affirm viability. Thus, it qualifies as a good pick amid bullish DeFi trends.

Should I Invest in JUPITER PERPS LP?

Your decision to invest in JLP hinges on embracing DeFi yields over spot holding. If Solana’s expansion excites you, its 10-20% APYs justify entry. Furthermore, airdrop perks from Jupiter quests add incentives.

Yet, volatility demands caution—allocate 5-10% of capital. Therefore, invest if you seek compounded growth; start modestly to test conviction.

Should I Invest in JUPITER PERPS LP or Bitcoin?

Bitcoin anchors portfolios as a scarcity-driven store of value, boasting institutional adoption and halving cycles.

Conversely, JLP thrives on DeFi utility, offering yields Bitcoin lacks. Thus, BTC suits preservation, while JLP fuels aggressive growth.

However, JLP’s risks eclipse BTC’s stability.

Thus, blend them: core in Bitcoin, satellite in JLP for diversified upside.

Will JUPITER PERPS LP Over Bitcoin?

JLP won’t eclipse Bitcoin’s dominance, given BTC’s $1T+ cap and global reserve status.

Instead, it targets DeFi niches, potentially outyielding BTC’s 0% native returns.

Moreover, Solana’s speed gives JLP an edge in transaction utility.

Yet, in raw appreciation, Bitcoin’s scarcity prevails. Therefore, JLP overperforms in yields, not market share—complementary, not competitive.

What Will JUPITER PERPS LP Be Worth in 2025?

Analysts forecast JLP’s 2025 value between $3.40 and $6.24, with conservative models at $5.01 max amid consolidation. Bullish scenarios, driven by jupUSD adoption, eye $5.3 averages per Bitget.

However, bearish outlooks predict $3.88 dips if volumes falter. Thus, expect $4.50-$5.50 mid-year, hinging on Solana’s momentum.

How Much Will JUPITER PERPS LP Be Worth in 2028?

By 2028, DigitalCoinPrice projects $22.36 peaks if DeFi matures. Factors like cross-margin expansions boost potential.

Conversely, competition tempers gains. Therefore, a $15 midpoint seems realistic, implying 3x from today.

What Will JUPITER PERPS LP Be Worth in 2030?

Long-term visions peg JLP at $6.76-$25.41 by 2030, with CoinArbitrageBot at $21.91 and DigitalCoinPrice at $25.41 on ecosystem scaling. BitScreener envisions $10.78 extremes in hyper-bull cases.

Yet, regulatory hurdles cap upside. Thus, $15-$20 averages align with moderate growth.

Will JUPITER PERPS LP Go Down in 2025?

Dips loom possible in 2025, with CoinCodex forecasting -24.63% to $3.88 amid fear indices at 21. Volume slumps or Solana corrections could trigger 15-20% pullbacks.

However, staking integrations counter declines. Therefore, short-term drops offer entry points, not a derailing trajectory.

Who Should Include JLP In Their Portfolios?

Yield chasers, Solana maximalists, and DeFi composability fans suit JLP best.

Additionally, leveraged traders borrowing against it thrive. Furthermore, airdrop hunters via quests gain extra value.

Conservatives may shy away from perp risks. Thus, integrate if your strategy favours income over stasis.

Is 2025 too late to buy JLP??

Far from it—2025 marks expansion, with jupUSD launches and Loans 2.0 ahead. At $4.7, post-consolidation entries beat 2024 peaks. Moreover, $17M daily volumes signal liquidity.

Thus, it’s prime time; accumulate for 2026 catalysts.

Is Investing in JLP Risky?

Indeed, JLP carries elevated risks: perp liquidations erode pools, and Solana outages (though rare) amplify exposure. A 10% activity drop slashes yields 15%, per analysts.

However, diversification via its basket mitigates singles. Thus, high-reward, high-risk—size positions wisely.

Could JLP Be A Bad Investment?

This could happen if Jupiter loses its perpetual share to rivals like Drift or if regulations limit leverage. Delays in roadmap execution could spark sell-offs.

However, a $1B market cap and integrations reduce failure odds. Therefore, bad hinges on mismanagement—monitor closely.

Does JLP Have a Future?

Absolutely— Solana’s DeFi boom, with billions of dollars in Jupiter volumes, secures JLP’s role. Partnerships like Ethena’s jupUSD ensure evolution.

Thus, a vibrant future awaits as perpetuals globalise.

How Safe is JUPITER PERPS LP?

JLP prioritises safety via audited code and Pyth oracles, minimising oracle exploits. Pool diversification hedges crashes, but counterparty risks persist in perps.

Overall, it’s safer than pure leverage plays, yet user wallet security is paramount.

How Legit is JUPITER PERPS LP?

Backed by Jupiter’s $137M funding and Solana’s core team, JLP exudes legitimacy. Transparent fees and major listings affirm trust—no red flags.

Thus, highly legit, a staple in DeFi.

Alternatives to Investing in JUPITER PERPS LP

Explore GMX on Arbitrum for cross-chain perpetual yields, or Pendle for tokenised APYs. Drift offers Solana-native alternatives, while Aave provides lending stability.

Diversify with these for balanced exposure.

Conclusion: Is JUPITER PERPS LP a Good Investment?

Synthesising JLP’s yields, integrations, and forecasts—like $5+ in 2025—reveals a promising asset. Risks temper enthusiasm, but Solana’s trajectory bolsters confidence.

Ultimately, yes—JLP shines for DeFi enthusiasts; invest strategically with other digital assets for compounded wins with an eye on the long term.