In the fast-paced realm of decentralised finance (DeFi), liquidity provision tokens like Jupiter Perps LP (JLP) capture the imagination of savvy investors seeking yield amid volatility.

Thus, as Solana’s DeFi ecosystem surges with innovative tools, JLP positions itself as a cornerstone for perpetual futures trading.

Therefore, this optimised review dissects JLP’s mechanics, weighing its compelling advantages against inherent pitfalls.

Moreover, with seamless integration into Jupiter Exchange—the Solana decentralised exchange (DEX) aggregator handling billions in volume—JLP offers a hybrid asset blending diversified exposure and passive income.

As a result, traders and holders alike actively engage, driving its relevance in 2025’s bull cycle.

Thus, whether you chase high annual percentage yields (APYs) or ecosystem growth, this guide equips you with actionable insights to navigate JLP’s potential.

Dive deeper to uncover if it aligns with your risk-reward profile in today’s crypto landscape.

What is Jupiter Perps LP (JLP)?

Jupiter Perps LP (JLP) functions as the powerhouse liquidity token, fuelling Jupiter Exchange’s perpetual futures platform on Solana.

Specifically, holders deposit assets such as SOL, ETH, WBTC, and USDC into the JLP pool, which traders borrow to open leveraged positions—up to 250x on major pairs.

In exchange, LPs earn hourly borrow fees, a 75% share of trading revenues, and liquidation profits, creating a self-reinforcing yield mechanism.

Furthermore, unlike traditional staking, JLP acts as a diversified index: its value mirrors the underlying basket while compounding from platform activity.

Developers and users benefit from integrations like Pyth oracles for precise pricing, ensuring low slippage and trustless execution.

Additionally, recent upgrades, including JLP Loans and SOL staking, enhance composability—holders can borrow against positions without selling, avoiding market reflexivity.

As of writing, Jupiter Perps LP (JLP) was exchanging hands for $4.7, reflecting steady demand amid Solana’s resurgence.

What’s more, the digital currency has had a minimum daily trading volume of $17 million throughout December 2025, showing robust liquidity.

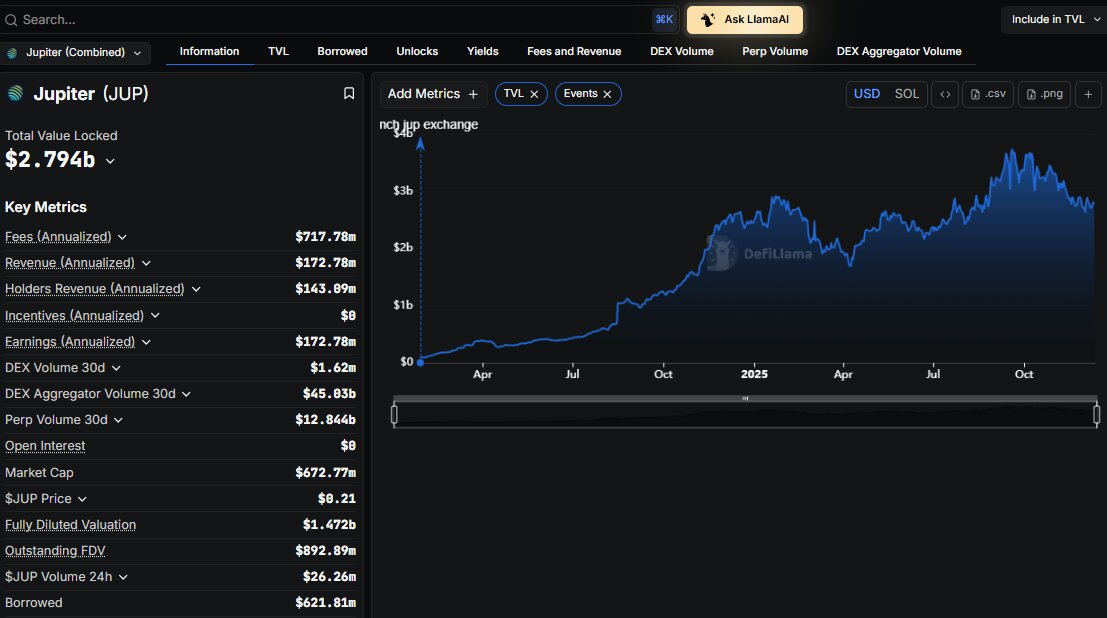

Throughout 2025, JLP has commanded a market capitalisation of more than $1 billion, cementing its status as a DeFi staple.

Supported by exchanges such as Orca, XT.COM, Raydium, CEX.IO, and Meteora, JLP trades effortlessly across DEXs and CEXs.

In essence, JLP transforms passive holding into active revenue generation, bridging spot and derivatives in Solana’s high-throughput environment.

Hence, it appeals to yield farmers eyeing sustainable returns over speculative flips.

The Pros of Investing in Jupiter Perps LP

Investors actively flock to JLP for its multifaceted appeal, blending security with explosive upside.

Primarily, it delivers consistent yields—often 10-20% APY—from real trading fees, outpacing many staking options without impermanent loss risks.

Moreover, the diversified basket (SOL, ETH, BTC, stables) provides broad crypto exposure, hedging against single-asset downturns while capturing Solana’s growth.

Furthermore, Jupiter’s dominance—80%+ of Solana perps volume—ensures fee accrual scales with ecosystem expansion.

Recent innovations, like jupUSD stablecoin integration with Ethena Labs, boost collateral quality and utility, elevating total value locked (TVL) beyond $2B.

Additionally, airdrop eligibility via perps activity sweetens the deal; past Jupuary drops rewarded top LPs handsomely.

Thus, JLP shines for long-term holders, offering compounding returns in a low-fee, high-speed network.

Consequently, as Solana DeFi matures, these pros position JLP as a resilient portfolio anchor.

The Cons of Investing in JLP

However, JLP’s allure comes tempered by notable drawbacks that demand careful consideration.

Chiefly, it exposes holders to perp market volatility: funding rate swings and mass liquidations can erode pool value during downturns, as seen in 10% volume drops slashing yields by 15%.

Moreover, dependency on Jupiter’s trading activity introduces single-protocol risk—if perp adoption wanes amid competition from Hyperliquid or Drift, fees could falter.

Additionally, the LP model amplifies impermanent loss subtly through asset rebalancing, particularly in skewed open interest scenarios.

Regulatory scrutiny on leveraged DeFi looms large, potentially capping leverage or inviting audits.

Finally, while listings on Orca and Raydium enhance access, thin liquidity on smaller pairs risks slippage for large trades.

Therefore, these cons urge diversification—JLP suits aggressive portfolios but falters in conservative setups.

How to Invest in JLP

Embarking on JLP investment proves straightforward, empowering newcomers to tap Solana’s yields swiftly.

Initially, secure a Solana-compatible wallet like Phantom or Backpack, funding it with SOL via fiat on-ramps like MoonPay.

Next, connect to Jupiter Exchange (jup.ag) and navigate to the Perps LP section—deposit equal values of SOL, ETH, WBTC, and USDC to mint JLP tokens directly.

For trading, leverage-supported platforms include swapping on Raydium or Orca for DEX purity or using XT.COM and CEX.IO for centralised ease.

Once acquired, stake JLP in the pool to accrue fees automatically, or explore JLP Loans for leveraged borrowing up to 80% loan-to-value (LTV) at reduced rates.

Monitor via Jupiter’s dashboard for APY trackers and position health. In short, these steps actively unlock JLP’s revenue streams.

Conclusion: So, Is JLP a Good Investment?

Balancing JLP’s robust pros against its volatility-driven cons reveals a compelling yet nuanced opportunity.

On one hand, its yield engine and Solana synergies drive tangible value; on the other, market dependencies test resilience.

If DeFi volumes swell—fuelled by mobile applications and prediction markets—JLP could thrive, rewarding patient holders with compounded gains. Conversely, bearish cycles amplify risks, demanding vigilant position sizing.

Ultimately, yes—Jupiter Perps LP qualifies as a good investment for yield-focused Solana bulls comfortable with moderate exposure. Allocate 5-10% of your portfolio, diversify with stables, and track Jupiter’s roadmap for sustained edge.

Will JLP Be A Millionaire Maker Token?

The millionaire-maker label sparks dreams, and JLP tantalisingly flirts with it through its explosive scalability.

Analysts project 2026 prices at $5.22 (5% growth baseline), escalating to $6.35 by 2030 amid more than 27% cumulative returns on investment (ROI). With an eye on the long term, CoinCodex analysts JLP could trade between $4 and $10 before the end of 2030.

For a $10K stake at $4.7, a $20 target yields $42K—not millions, but scaling to $100K and $1M beckons at $47 (10x).

The community’s sentiment reflects this: X buzz praises JLP as “Solana’s DeFi engine”, and TVL milestones indicate virality similar to GLP’s Arbitrum run.

Yet, millionaire status demands flawless execution—evade leverage crashes and regulatory snags.

Therefore, despite the lack of certainty, the utility of JLP suggests the possibility of a future price milestone. Buying a token at $4 is still a great barrier to entering the cryptocurrency market. Position early, hold through volatility, and JLP might just be the asset to transform your fortunes.